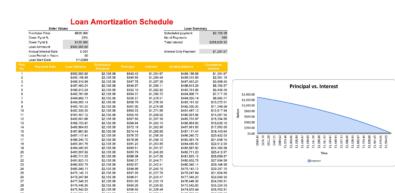

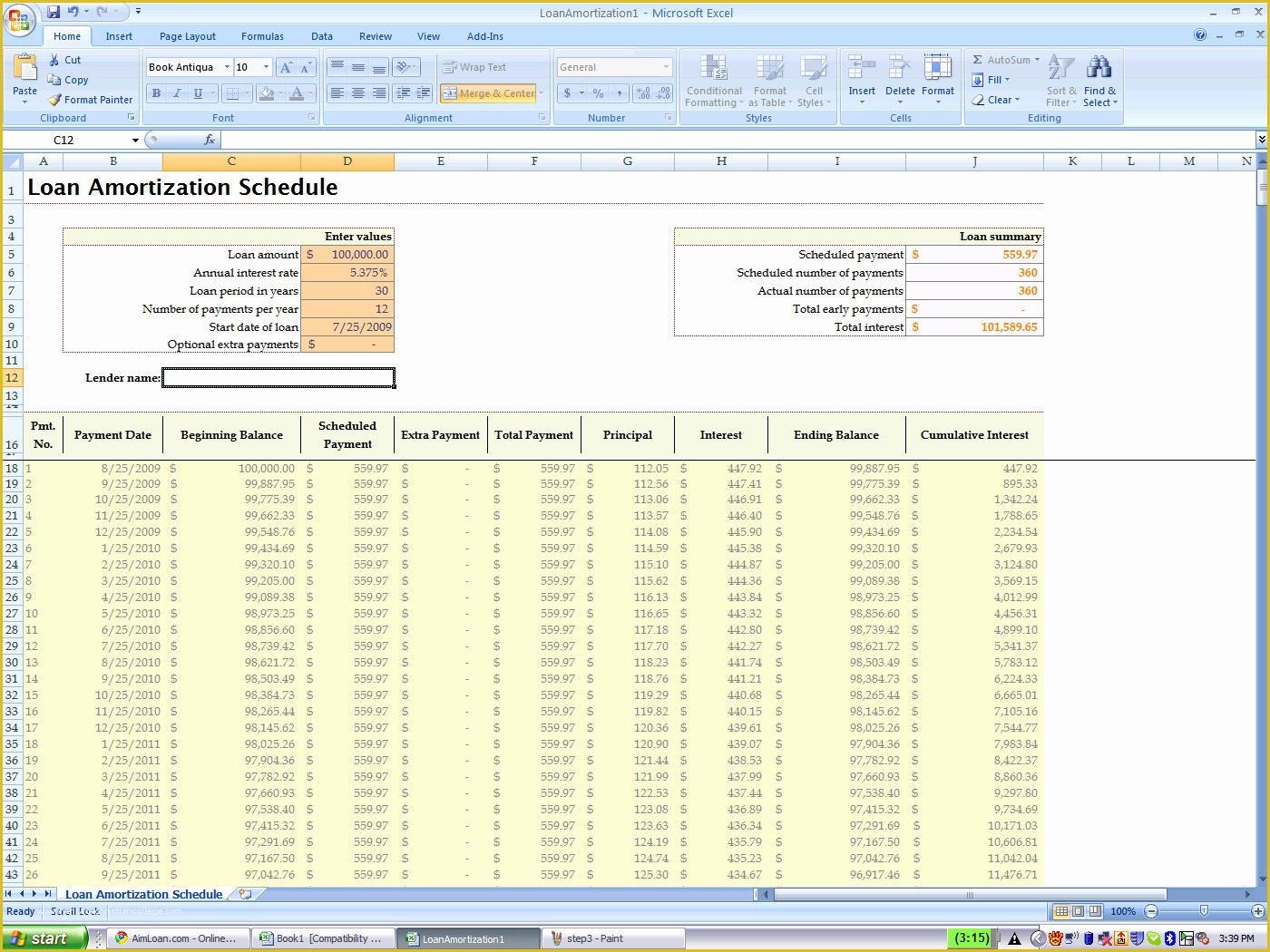

We will use the PMT function to create an Excel loan calculator with extra payments. If the loan amount, interest rate, and the number of periods are present, then you can calculate the required payments that will fully repay the loan by using the PMT function. Combining the PMT, IPMT, and PPMT Functions to Create an Excel Loan Calculator with Extra Payments Read More: Create Home Loan Calculator in Excel Sheet with Prepayment OptionĢ. You can see that, after the 12th installment, you will be able to repay the loan with extra payments.Lastly, use the AutoFill Tool and drag the formula to the lower cells in column H.Then, press Enter and get the value for the balance in cell H13, which is $ 27,462.40.To do this use the following formula by applying the IFERROR function.Firstly, calculate the scheduled payment in cell C9.The steps for this method are as follows. We can create an Excel loan calculator with extra payments by applying the IFERROR function. Applying IFERROR Function to Create an Excel Loan Calculator with Extra Payments We will use the following sample data set to create an Excel loan calculator with extra payments.ġ. In this article, we will use the IFERROR function in the first solution and a combination of the PMT functions, the IPMT function, and the PPMT function in the second approach to create an Excel loan calculator with extra payments. In loan instalments, extra payments help to repay the loan earlier. Using Excel in this regard will help you to determine your payable amount correctly.

It is an important issue for the loan payer and receiver to determine and calculate the exact amount of instalment or payment per month regarding the payable amount and interest rate. 2 Suitable Examples to Create an Excel Loan Calculator with Extra Payments

0 kommentar(er)

0 kommentar(er)